delayed draw term loan accounting

THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again.

Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

. This draw approval process ideally takes about seven business days. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities. Examples include credit card bank overdraft trade credit Trade Credit The term trade credit refers to credit provided by a supplier to a buyer of goods or services.

13 Accounting TermsCalculation of Financial Covenants. Financing fees example. The withdrawal periods are also determined in advance.

Reviewing the draw request. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. The coupon may be fixed or based on a variable interest rate.

With a DDTL you can withdraw funds several times from a predetermined loan amount. A separate loan account should be established in the balance sheet for each loan. This contrasts with commitment fees on revolvers of 50bp.

Any portion of the Delayed Draw Term Loan repaid or prepaid may not be reborrowed. The outstanding principal amount of the Delayed. The amount recorded is termed the loan principal.

All accounting terms used in this Agreement shall have the meaning ascribed to such terms by such principles. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Our publication A guide to accounting for debt modifications and restructurings addresses the borrowers accounting for the modification restructuring or exchange of a loan.

This makes it is possible to buy goods or services from a supplier on credit rather than paying cash up front. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years. The update impacts both private and public companies and applies to term loans bonds and any borrowing that has a defined payment schedule.

This gets you around 1239mo for the full payments and 70833mo for the interest-only payments. Amortize the loan amount for 120 months with payments due Feb 1 2015 through Jan 1 2015 and run a 12-month interest-only loan for 100000 with payments due Feb 1 2014 through Jan 1 2015. Term debt has a specified term and coupon.

3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date. EX-1022 7 fs42020a2ex10-22_insuranchtm AMENDED AND RESTATED DELAYED DRAW TERM LOAN AGREEMENT DATED OCTOBER 18 2019 BY AND AMONG SHIFT TECHNOLOGIES INC SHIFT OPERATIONS LLC SHIFT FINANCE LLC AND LITHIA. Recorded event now available.

Once a draw request has been submitted to the lender the review process begins. Determining whether a loan modification constitutes a TDR is a two-step process. Determine if the bank is granting a concession ie modified terms are more attractive than standard market terms that is more than insignificant.

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Below is an example of debt issuance costs treatment pre- and post-ASU 2015-03. Upon issuance the issuer recognizes a liability equal to the proceeds eg cash received less any allocation of proceeds to other instruments issued with the debt or features within the debt instrument itself.

These ticking fees start at 1. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. Liabilities reduced by a 125000 and simultaneously owners capital went down by the interest amount ie 42500.

Determine if the borrower is experiencing financial difficulty ie is the borrower actually troubled. The primary decision points considered by the. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

The revolving loans are approved for the short-term usually up to one year. A Unless terminated sooner pursuant to Section 205 a iii C the Total Delayed Draw Term Loan Commitment shall terminate at 500 pm. In this case an asset cash increases as the money is received into the bank account of the business and a liability loan increases representing the amount owed to the bank in accordance with the loan agreement.

New York City time on the DDTL Commitment Expiration Date. The amendment provides for among other things an increase to the existing term loan facility in the amount of 400 million Incremental Term Loans and. Us Financing guide 12.

The lender needs to review all the documents order and approve inspections and verify that all the work claimed to be completed has been. After the loan is paid off the net effect of these transactions on the accounting equation will be as follows. The accounting implications differ depending on whether the borrowers or lenders accounting is being considered.

This CLE course will discuss the terms and structuring of delayed draw term loans. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation.

A short-term loan is a credit facility extended to individuals and entities to finance a shortage of cash. See All 5 Delayed Draw Term Loan. The assets of the company decreased by 167500.

A company borrows 100 million in a 5-year term loan and incurs 5 million in financing fees. An accordion feature in a line of credit allows a business to increase that line of credit if necessary often to obtain more working capital or emergency cash. A draw period is the amount of time you have to withdraw funds.

The Borrower shall repay 025 of the outstanding Delayed Draw Term Loan if any A on the last day of the Fiscal Quarter following the Fiscal Quarter in which the first drawing under the Delayed Draw Term Loan was made and B on the last day of each Fiscal Quarter of the Borrower thereafter. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them. The accordion feature is an added.

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

7 3 Classification Of Preferred Stock

Delayed Draw Term Loan Ddtl Overview Structure Benefits

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

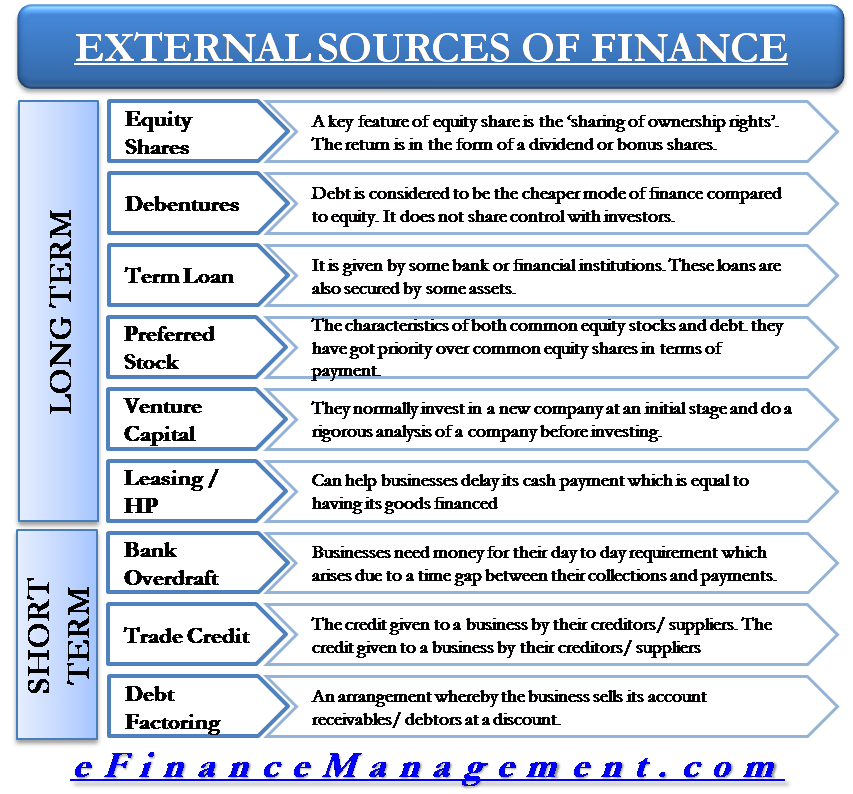

External Sources Of Finance Capital

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Balance Sheet Long Term Liabilities Accountingcoach

Understanding The Construction Draw Schedule Propertymetrics

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

/GettyImages-175520675-fad3bb7af6aa4da48f02d47ba57a7432.jpg)